sales tax in san antonio texas 2019

Box is strongly encouraged for all incoming mail. What is the sales tax rate in San Antonio Texas.

Housing Market Austin Chamber Of Commerce

PersonDepartment.

. You will pay sales tax on an item bought online if the retailer has a store somewhere in the state of Texas. Mailing Address The Citys PO. Sales tax in san antonio texas 2019 Tuesday September 6 2022 Edit.

Supermarket News ranks H-E-B 13th on the list of Top 75 North American Food Retailers by. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. Test drive Used 2019 Ford F250 at home in San Antonio TX.

San antonio sales tax is at 815 percent still I 2019 San. 743 Mizuno Way San Antonio TX 78221-2019 295132 MLS 1641650 This home has everything you could want. The average cumulative sales tax rate in San Antonio Texas is 823 with a range that spans from 675 to 825.

The San Antonio sales tax rate is. San Antonio TX 78205. In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county.

It doesnt just do one fiesta. Please consult your local tax authority for specific details. 6135 Pleasant Lake San Antonio TX 78222 is a 3 bedroom 2 bathroom single-family home built in 2016.

The 825 sales tax rate in. In 2017 70 of high school students in Texas smoked cigars cigarillos or little cigars on. Sales and Use Tax.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. San antonio texas sales tax rate 2019 San Antonio Texas knows how to party.

Search from 39 Used Ford F250 for sale including a 2019 Ford F250 King Ranch a 2019 Ford F250 Lariat and a 2019 Ford F250. In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose district when applicable. The December 2020 total local sales tax rate was also 8250.

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. 6135 Pleasant Lake is located in. The sales tax for San Antonio is 625.

This includes the rates on the state county city and special levels. Published on August 2 2019 by Youngers Creek. City of San Antonio Attn.

Texas state rate 625. Local taxing jurisdictions cities counties special. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in San Antonio.

5 beds 25 baths 2549 sq. It does a whole Fiesta Week. 625 san antonio tax 125.

And that week isnt just one week long.

Housing Market Austin Chamber Of Commerce

Sales Taxes In The United States Wikipedia

Financials Pre K 4 San Antonio

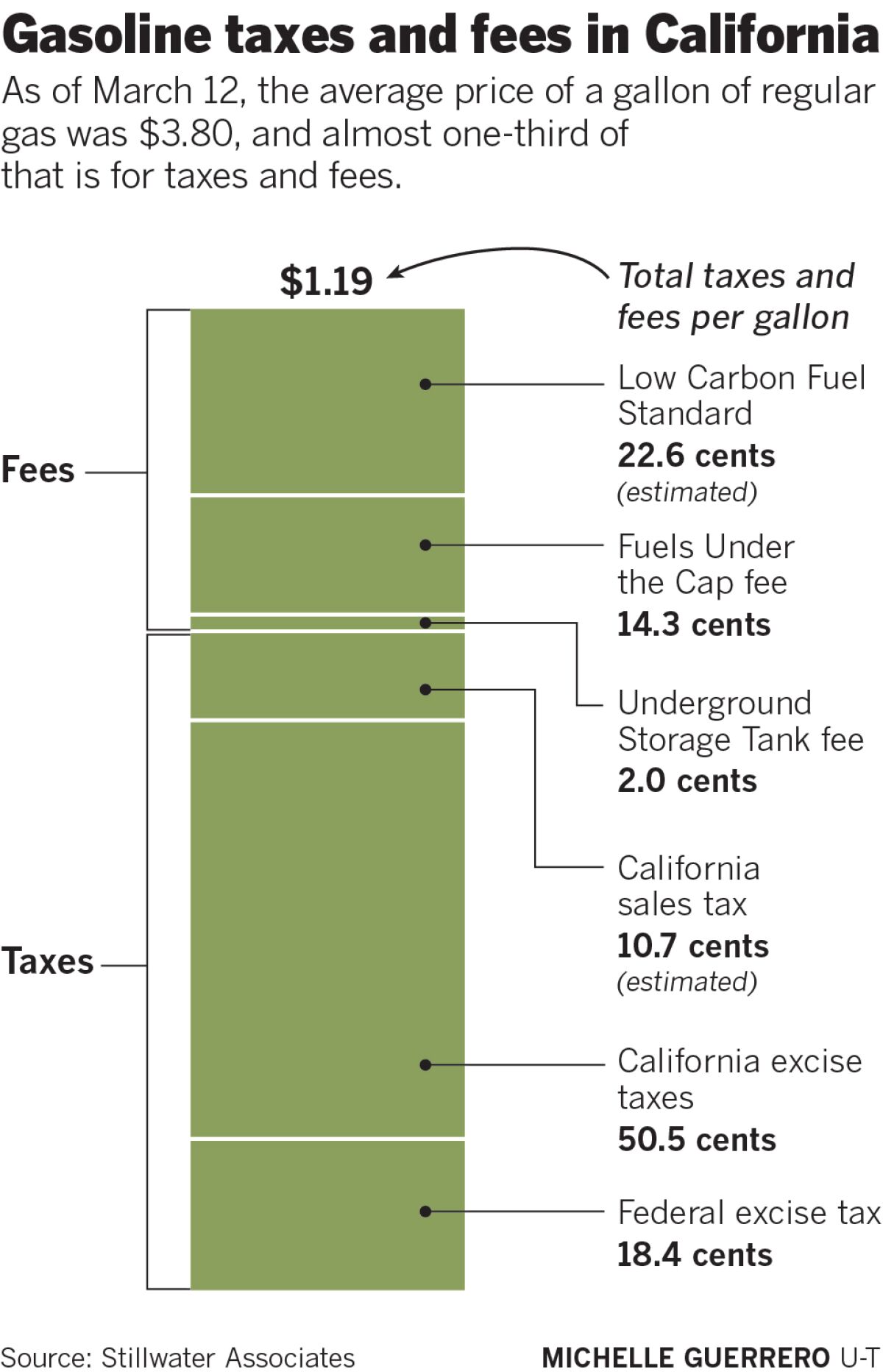

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune

Job Opportunities Sorted By Job Title Ascending Career Center

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

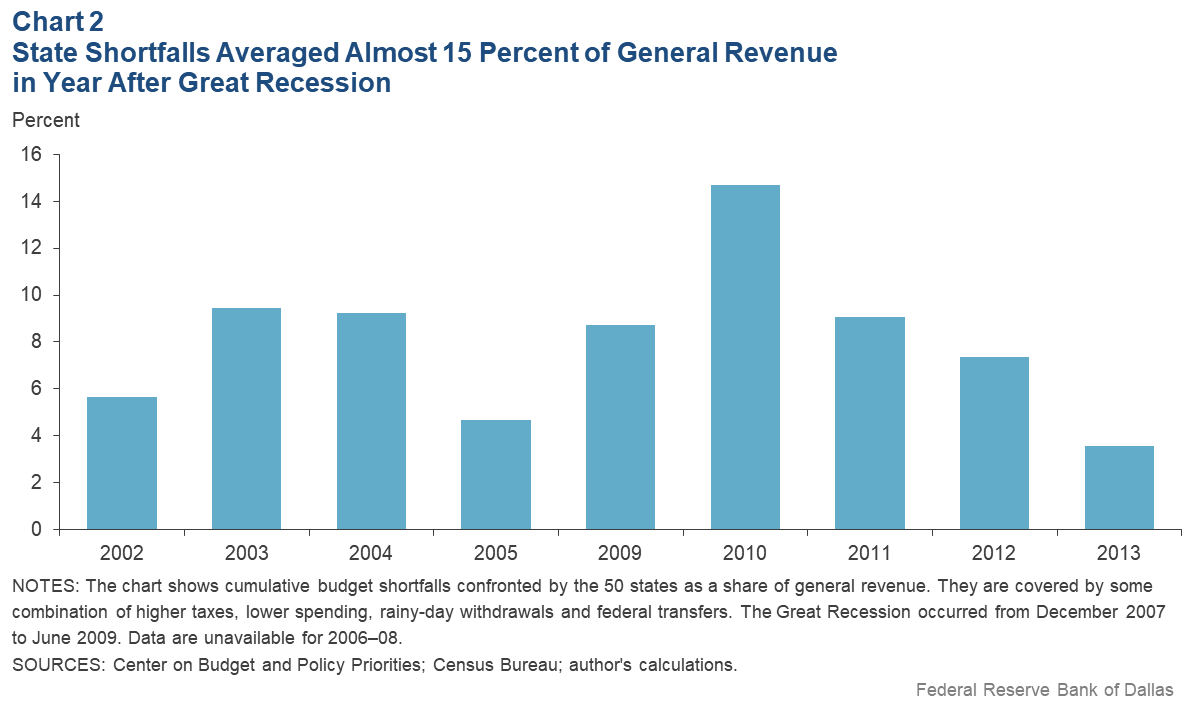

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

San Japan Anime Convention San Japan

Sales Tax Holidays Set For Memorial Day Weekend Texas Farm Bureau

Most Texans Pay More In Taxes Than Californians Reform Austin

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Economic Indicators For South Texas Show Steady Growth For 2020 Virtual Builders Exchange

Tax Information Mckinney Tx Official Website

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org